- When to amend. You should amend your tax return if you need to correct filing status, the number of dependents or total income. You should also amend your return to claim tax deductions or tax credits that you did not claim when you filed your original return. The instructions for Form 1040X, Amended U.S. Individual Income Tax Return, list more reasons to amend a return.

- When NOT to amend. In some cases, you don’t need to amend your tax return. The IRS will make corrections, such as math errors, for you. If you didn’t include a required form or schedule, for example, the IRS will mail you a notice about the missing item.

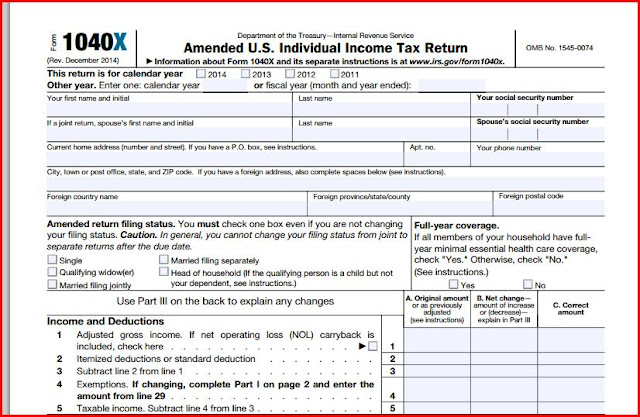

- Form 1040X. Use Form 1040X to amend a federal income tax return that you filed before. You must file it by paper; you cannot file it electronically. Make sure you check the box at the top of the form that shows which year you are amending. Form 1040X has three columns. Column A shows amounts from the original return. Column B shows the net increase or decrease for the amounts you are changing. Column C shows the corrected amounts. You should explain what you are changing and the reasons why on the back of the form

- More than one tax year. If you file an amended return for more than one year, use a separate 1040X for each tax year. Mail them in separate envelopes to the IRS. See "Where to File" in the instructions for Form 1040X for the address you should use.

- Other forms or schedules. If your changes have to do with other tax forms or schedules, make sure you attach them to Form 1040X when you file the form. If you don’t, this will cause a delay in processing.

- Amending to claim an additional refund. If you are waiting for a refund from your original tax return, don’t file your amended return until after you receive the refund. You may cash the refund check from your original return. Amended returns take up to 16 weeks to process. You will receive any additional refund you are owed.

- Amending to pay additional tax. If you’re filing an amended tax return because you owe more tax, you should file Form 1040X and pay the tax as soon as possible. This will limit interest and penalty charges.

- Reconciling the Premium Tax Credit. You may also want to file an amended return if:

• You filed and incorrectly claimed a premium tax credit, or

• If you received a corrected or voided Form 1095-A. - When to file. To claim a refund file Form 1040X no more than three years from the date you filed your original tax return. You can also file it no more than two years from the date you paid the tax, if that date is later than the three-year rule.

- Track your return. You can track the status of your amended tax return three weeks after you file with “Where’sMy Amended Return?”

Individual and Business Tax Preparation - Tax Wise Strategies - Bookkeeping - Quickbooks Training.

Wednesday, July 6, 2016

Tips on Filing an Amended Tax Return

If you find that you made a mistake on your tax return, you can file an amended return. You can also amend your tax return if you need to claim a tax credit or deduction.

Friday, July 1, 2016

Claiming your child as a dependent

To claim your child as your dependent, your child must meet the qualifying child test or the qualifying relative test.

Qualifying Child Rules

Relationship

- Your son, daughter, adopted child, stepchild, foster child or a descendant of any of them such as your grandchild

- Brother, sister, half brother, half sister, step brother, step sister or a descendant of any of them such as a niece or nephew

Age

- At the end of the filing year, your child was younger than you (or your spouse if you file a joint return) and younger than 19

- At the end of the filing year, your child was younger than you (or your spouse if you file a joint return) younger than 24 and a full-time student

- At the end of the filing year, your child was any age and permanently and totally disabled1

Residency

- Child must live with you (or your spouse if you file a joint return) in the United States for more than half of the year

Joint Return

- The child cannot file a joint return for the tax year unless the child and the child's spouse did not have a separate filing requirement and filed the joint return only to claim a refund.

IMPORTANT: Only one person can claim the same child. If a child qualifies for more than one person and one of the persons is a parent or parents, the non-parent can claim the child only if their AGI is higher than the parent(s). If the child qualifies another relative and the parent AGI rules do not apply, the taxpayers choose. If more than one person claims the same child, IRS applies the tiebreaker rules.

1Permanently and totally disabled. Your child is permanently and totally disabled if both of the following apply: The child cannot engage in any substantial gainful activity because of a physical or mental condition and a doctor determines the condition has lasted or can be expected to last at least a year or lead to death.

Qualifying Relative

To be a your qualifying relative, the person cannot be your qualifying child, and must live with you all year as a member of your household, or be related to you in any of the following ways doesn't have to live with you all year as a member of your household to meet this test.

-

Your child, stepchild, foster child, or a descendant of any of them (for example, your grandchild). (A legally adopted child

is considered your child.)

-

Your brother, sister, half brother, half sister, stepbrother, or stepsister.

-

Your father, mother, grandparent, or other direct ancestor, but not foster parent.

-

Your stepfather or stepmother.

-

A son or daughter of your brother or sister.

-

A son or daughter of your half brother or half sister.

-

A brother or sister of your father or mother.

-

Your son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law.

A person's gross income for the year must be less than $4,000 and you generally must provide more than half of a person's total support during the calendar year.

If two or more persons provide support, but no one person provides more than half of a person's total support, you can agree that any one of you who individually provides more than 10% of the person's support, but only one, can claim an exemption for that person as a qualifying relative. Each of the others must sign a statement agreeing not to claim the exemption for that year. The person who claims the exemption must keep these signed statements for his or her records. A multiple support declaration identifying each of the others who agreed not to claim the exemption must be attached to the return of the person claiming the exemption. Form 2120 can be used for this purpose.

Unlike a qualifying child, a qualifying relative can be any age.

In addition to meeting the qualifying child or qualifying relative test, you may claim a dependency exemption for your child as long as all of the following tests are met:

- If you can be claimed as a dependent by another person, you cannot claim anyone else as a dependent.

- You generally cannot claim a married person as a dependent if he or she files a joint return. (only to claim a refund of income tax withheld or estimated tax paid).

- You generally cannot claim a person as a dependent unless that person is a U.S. citizen, U.S. resident alien, U.S. national, or a resident of Canada or Mexico (Exception for adopted child).

contact@officetaxservices.com

(858)247-1680

Thursday, June 30, 2016

How to notify the IRS your address has changed

You can change your address on your tax return.

_________________________________________________________________________

You can use Form 8822 (if you would like to change your home mailing address) or Form 8822-B (if you would like to change your business mailing address).

_________________________________________________________________________

You can send the IRS a signed written statement with you:

_________________________________________________________________________

You can go to the IRS next to you. You'll need to inform them:

You can call the IRS at +1 800-829-1040 and provide:

If you refund check was returned to the IRS, you can you use Where is my refund to complete your change of address online. You will need your SSN, filing status, and the amount of your refund. _________________________________________________________________________

If you filed a joint return, you should provide the information and signatures for both spouses.

It can take four to six weeks for a change of address request to be fully processed.

_________________________________________________________________________

You can use Form 8822 (if you would like to change your home mailing address) or Form 8822-B (if you would like to change your business mailing address).

_________________________________________________________________________

You can send the IRS a signed written statement with you:

- full name

- old address

- new address

- social security number (or ITIN number or EIN number)

_________________________________________________________________________

You can go to the IRS next to you. You'll need to inform them:

- your full name

- your address

- your date of birth

- your social security number (or ITIN number or EIN number)

You can call the IRS at +1 800-829-1040 and provide:

- your full name

- your address

- your date of birth

- your social security number (or ITIN number or EIN number)

If you refund check was returned to the IRS, you can you use Where is my refund to complete your change of address online. You will need your SSN, filing status, and the amount of your refund. _________________________________________________________________________

If you filed a joint return, you should provide the information and signatures for both spouses.

It can take four to six weeks for a change of address request to be fully processed.

contact@officetaxservices.com

(858)247-1680

Wednesday, June 29, 2016

If you claim standard deduction...

If you claim standard deduction, you cannot itemized deductions.

The standard and itemized deduction is a dollar amount that reduces your taxable income, but you cannot claim both. You should claim whichever one is higher.

Certain taxpayers cannot use the standard deduction:

- A married individual filing as married filing separately whose spouse itemizes deductions.

- An individual who files a tax return for a period of less than 12 months because of a change in his or her annual accounting period.

- An individual who was a nonresident alien or a dual-status alien during the year. Nonresident aliens who are married to a U.S. citizen or resident alien at the end of the year and who choose to be treated as U.S. residents for tax purposes can take the standard deduction.

- An estate or trust, common trust fund, or partnership;

Itemized deductions include amounts you paid for state and local

income or sales taxes, real estate taxes, personal property taxes,

mortgage interest, and disaster losses. You may also include gifts

to charity and part of the amount you paid for medical and dental

expenses. You would usually benefit by itemizing on Form 1040, Schedule A, if you:

- Cannot use the standard deduction

- Had large uninsured medical and dental expenses

- Paid interest or taxes on your home

- Had large unreimbursed employee business expenses

- Had large uninsured casualty or theft losses, or

- Made large charitable contributions

Your itemized deductions may be limited and your total itemized deductions may be phased out (reduced) if your adjusted gross income for 2015 exceeds the following threshold amounts for your filing status.

If you have any questions, send us a message or leave a comment. We will be more than happy to help you.

contact@officetaxservices.com

(858)247-1680

Friday, June 24, 2016

Subscribe to:

Posts (Atom)